Gallup’s latest year-ahead expectations survey shows Americans bracing for a difficult 2026 across economics, governance, and global stability, creating a volatile midterm environment for both parties.

What to Know:

- The only majority-positive expectation is the stock market: 55% say it will rise (vs. 44% falling).

- Kitchen-table indicators lean negative: 59% expect prices to rise at a high rate, 62% expect taxes to rise, and 62% expect rising unemployment.

- Governance expectations are bleak: 89% predict political conflict (only 10% foresee cooperation).

- Year-over-year optimism fell sharply on bread-and-butter measures, including full/increasing employment down 18 points (54% to 36%) and “taxes will fall” down 14 points (50% to 36%).

- Partisans view 2026 through different lenses: Republicans are far more upbeat than Democrats, for example economic prosperity at 63% (GOP) vs. 7% (Dem), while independents sit in between at 27%.

This summary is based on Gallup’s “Americans Predict Challenging 2026 Across 13 Dimensions” (Megan Brenan), a nationally representative probability-based Gallup Panel web survey fielded Dec. 1–14, 2025.

Image from Gallup

The Mood Heading Into 2026: Defensive and Distrustful

Gallup tested expectations across 13 dimensions, spanning the economy, governance, social conditions, and international affairs. Majorities forecast negative outcomes in nearly every category, with the public split only on labor union strikes and Russia’s global power. The topline signal is not just “concern,” it is an electorate expecting turbulence as the midterm cycle ramps up.

Dashboard-style graphic summarizing the 13 outlook dimensions, highlighting the single bright spot (stock market) against broader pessimism.generated by Campaign Now with Gemini using Data from Gallup.

For strategists, this matters because expectations often shape receptivity. When voters expect deterioration, they scrutinize incumbents more aggressively and demand proof, not just promises. That dynamic can cut against whoever is perceived as “in charge,” but it also punishes candidates who sound detached from lived experience.

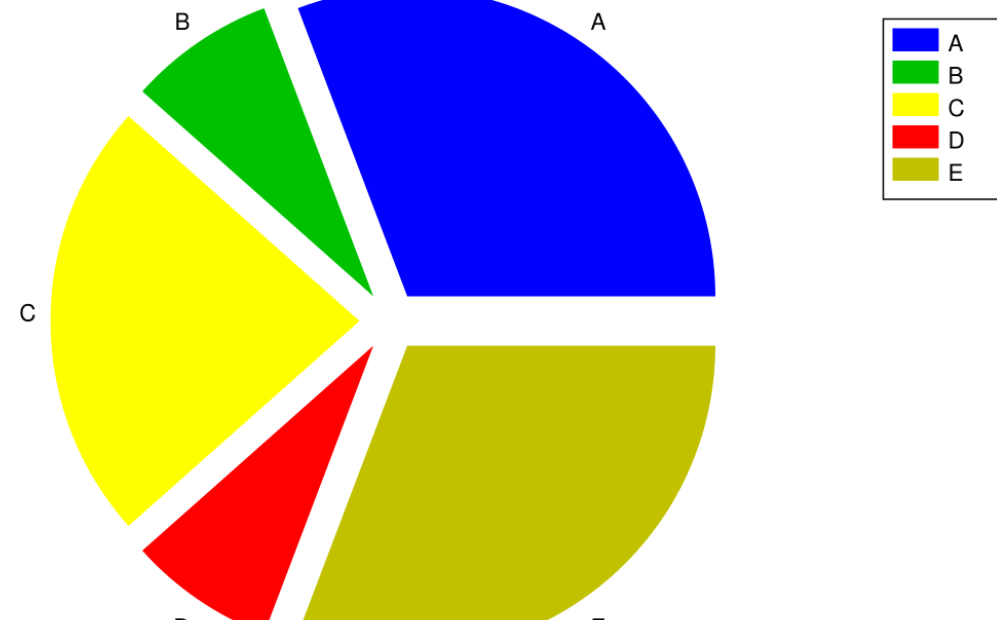

Wall Street Optimism, Main Street Anxiety

The standout datapoint is the market. A majority, 55%, expects the stock market to rise. But optimism collapses on daily life indicators: 59% anticipate prices rising at a high rate, 62% expect taxes to rise, and 62% expect rising unemployment.

Chart showing the disparity between stock market optimism and economic difficulty predictions, generated by Campaign Now with Gemini using Data from Gallup.

This is the classic “numbers up, feeling down” environment. Campaigns that lean on abstract economic metrics risk sounding out of touch if voters believe their purchasing power, job security, and tax burden are moving in the wrong direction.

“Clear majorities also expect rising unemployment, taxes, prices and crime rates, along with declining American power in the world.”— Gallup (Megan Brenan)

The strategic implication is straightforward: success will depend on whether candidates can translate macro claims into micro credibility, with specific commitments that connect to cost-of-living and economic security.

Political Dysfunction Is Baked In

The most lopsided expectation in the entire battery is governance. Only 10% foresee political cooperation, while 89% predict political conflict.

Infographic highlighting the 89% prediction of political conflict. Caption, generated by Campaign Now with Gemini using Data from Gallup.

Infographic highlighting the 89% prediction of political conflict. Caption, generated by Campaign Now with Gemini using Data from Gallup.

That baseline assumption changes how “unity” messaging lands. Voters are not expecting Washington to work. They are expecting a fight. For candidates, this increases the premium on competence signals and on framing conflict as purposeful, results-driven, and tied to the voter’s interests.

The trap is performative outrage. In a conflict-expecting environment, voters may reward a “fighter,” but they still punish chaos that fails to deliver tangible outcomes. Campaigns that can credibly say “we will fight, and here is what we will get done” have an edge.

The Year-Over-Year Slide: A Bad Sign for Incumbents

Gallup reports that Americans’ predictions for 2026 are “considerably more negative” than for 2025, with double-digit declines in positive expectations on multiple measures. The sharpest drop is employment: full or increasing employment fell 18 points from 54% to 36%. Expectations that taxes will fall dropped 14 points from 50% to 36%. Economic prosperity fell 14 points from 44% to 30%.

Graph displaying the year-over-year decline in positive predictions from 2025 to 2026, generated by Campaign Now with Gemini using Data from Gallup.

“Americans’ predictions for 2026 are considerably more negative than they were for 2025. This increased negativity includes double-digit declines … in positive predictions for employment, taxes, economic prosperity … political cooperation, prices, and the stock market.” — Gallup (Megan Brenan)

For the midterm environment, declines like this typically raise the probability of volatility. Even if the underlying conditions are mixed, perceptions drive turnout incentives, persuasion openness, and the appetite for change.

Partisanship Still Dominates, but the Shift Is the Story

Party identification remains the strongest factor shaping expectations. Republicans are broadly optimistic across most measures, while Democrats are broadly pessimistic. Independents are more cautious and tend to align closer to the overall national mood.

A few anchor points:

- Economic prosperity: 63% Republicans, 27% independents, 7% Democrats.

- Stock market rising: 81% Republicans, 54% independents, 35% Democrats.

- Political cooperation: 17% Republicans, 8% independents, 7% Democrats.

Gallup also notes the overall shift toward negativity is driven largely by Republicans becoming significantly more pessimistic compared with last year, even though they remain the most optimistic group.

That combination matters: a base that is still optimistic but increasingly disappointed can be energized by “delivery” messaging and frustrated by perceived dysfunction. Meanwhile, the independent bloc looks like a classic persuasion segment: selective optimism, broad caution, and likely high sensitivity to cost-of-living and competence cues.

What This Means for Republicans and Democrats in 2026

For Republicans, the strategic challenge is to hold onto high baseline optimism while addressing mainstream anxiety that shows up in the toplines. Republicans can lean into competence, order, and affordability themes, but they must avoid sounding like everything is already fine when majorities expect high prices and rising unemployment. The best posture is likely “results-focused change,” grounded in tangible policy commitments and a clear contrast on economic management.

For Democrats, the environment is a warning sign. With voters expecting economic difficulty at 68% and political conflict at 89%, reassurance without proof will underperform. Democrats may benefit from validating the anxiety and then making a credibility play around practical cost relief, institutional performance, and governance outcomes. The goal is to reduce the “in charge” penalty by demonstrating visible action, not just positioning.

For both parties, independents are the likely hinge. Their optimism is limited to a few items like the stock market at 54%, with less belief that other positive outcomes will occur. That profile typically rewards candidates who communicate seriousness, specificity, and steadiness.

Wrap Up

Gallup’s 2026 expectations survey shows an electorate anticipating a difficult year on core economic conditions, global stability, and especially political functionality. The only real bright spot is market optimism, but it does not translate into confidence on prices, taxes, or employment.

For Republicans and Democrats alike, the strategic takeaway is that 2026 will reward credibility and competence. Voters are already pricing in conflict and instability, so the candidates most likely to gain traction are those who can connect big-picture arguments to everyday pressure points, and then present a plausible path to stability that feels real.