Why the House Will Be Decided on the Margins, Not by a Wave

What to Know

- Fewer than forty House districts are meaningfully competitive heading into 2026, creating a sharply compressed battlefield.

- Republicans enter the cycle defending most true Toss-Up seats, while Democrats must protect a broader perimeter of Lean and Tilt districts.

- Control of the House could hinge on micro-shifts of two points or less in turnout or persuasion.

- California, New York, Michigan, Pennsylvania, and Nevada contain the highest concentration of decisive races.

- The era of wave elections has given way to knife-edge majorities driven by district-level execution.

The modern House map is defined by scarcity. Structural sorting, redistricting, and geographic polarization have reduced the number of persuadable districts to a thin band where even modest disruption can flip control. In this environment, campaigns are rewarded for precision and punished for overreach.

How Close Is the 2026 House Map?

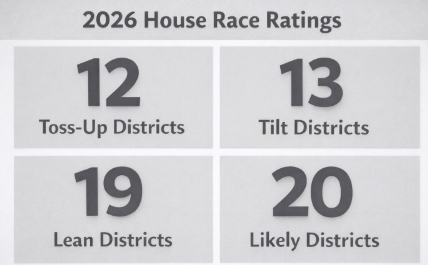

The 2026 House battlefield is not defined by sweeping national trends, but by a razor-thin slice of districts where control can shift on the margins. With most seats effectively locked in, the balance of power now hinges on a limited number of competitive races, many separated by only a few points. This compressed map leaves little room for error and magnifies the impact of turnout, messaging, and resource allocation, making the fight for the majority tighter and more unforgiving than at any point in the modern era. The current competitive distribution underscores just how narrow the fight has become:

- 12 Toss-Up districts

- 13 Tilt districts

- 19 Lean districts

- 20 Likely districts

Republicans are defending most of the true Toss-Up districts and nearly half of all Tilt seats, putting their majority squarely in the danger zone. These are seats with thin margins and volatile electorates, where even small mistakes can have immediate consequences. Democrats hold the bulk of the Lean seats, but many sit in states facing demographic shifts, economic anxiety, or turnout instability. Those advantages are real, but fragile. The result is a highly concentrated battlefield. Control of the House will be decided in a narrow set of races where precision matters more than momentum, and where a single misstep in spending, messaging, or turnout can be enough to flip the majority.

Read the full article: Why the 2026 House Will Be Decided on the Margins

The True Toss-Ups: Where Control Is Most Fragile

Toss-Up districts form the structural core of the 2026 House battle. These are the seats where partisan advantages collapse and elections are decided on narrow margins, shaped by local pressures as much as national mood. They span a wide range of geographies and voter coalitions, from suburban districts squeezed by cost-of-living concerns to rural–suburban hybrids pulled in opposite directions by cultural polarization and economic stress.

Republicans are defending the majority of these seats, including some of the most exposed districts in Arizona, Michigan, New York, Virginia, and Nebraska. In many cases, these incumbents face electorates that have grown less predictable and more sensitive to national conditions. Democrats hold fewer Toss-Ups overall, but the ones they do control are no less volatile, particularly in California and parts of the South where turnout swings and demographic churn can quickly reshape the electorate.

These districts are the first to respond when the political environment shifts. Changes in presidential approval, economic confidence, or late-breaking narratives tend to register here before they show up anywhere else. That makes Toss-Ups the primary focus of national party committees and outside groups, which pour resources into persuasion, turnout, and rapid response operations. In a closely divided House, these seats are not just competitive. They are the pressure points where control is most likely to break.

Read the full article: The 20 Districts That Will Decide the House

Tilt Districts: The Early-Warning System

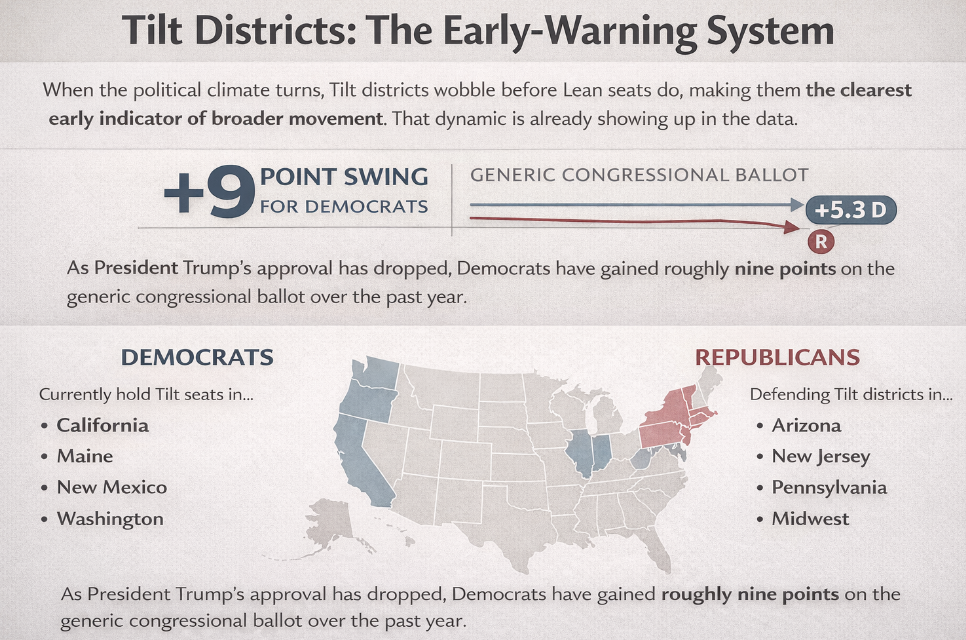

Tilt districts are where shifts in the national environment first become visible. These seats sit just beyond true Toss-Ups, held together less by partisan loyalty than by candidate quality, localized trust, and careful coalition management.

When the political climate turns, Tilt districts wobble before Lean seats do, making them the clearest early indicator of broader movement. That dynamic is already showing up in the data. As President Trump’s approval has declined, Democrats have gained a roughly nine-point swing on the generic congressional ballot over the past year, a national shift that historically puts Tilt districts under immediate pressure.

Democrats currently hold Tilt seats in states like California, Maine, New Mexico, and Washington, while Republicans are defending Tilt terrain across Arizona, New Jersey, Pennsylvania, and much of the Midwest. These districts are highly sensitive to national mood, even when incumbents maintain strong local brands.

When Tilt seats begin to move, it usually reflects more than a single bad poll. It signals weakening message discipline, eroding presidential coattails, or growing voter unease that is likely to spill into Lean districts next. In that sense, Tilt districts function as the House map’s warning lights. By the time they flip, the environment is no longer theoretical. It is already reshaping the battlefield.

Read the full article: Democrats Gain 9-Point Swing in Generic Ballot as Trump’s Approval Sinks

Lean and Likely Districts: The Perimeter Risk

Lean districts form the outer edge of the 2026 battlefield. They usually hold in neutral political environments, but they are far less secure than their labels suggest. When turnout softens, presidential approval declines, or economic anxiety sharpens, these seats are often the next to crack. In a D+5 national environment, they become pressure points rather than safe ground.

Democrats currently control most Lean seats, spread across California, Nevada, the Midwest, and the Northeast. Many of these districts benefit from favorable demographics, but they are not immune to midterm dynamics, particularly in areas experiencing cost-of-living strain or uneven turnout. Republicans hold fewer Lean seats overall, but remain exposed in suburban districts where resistance to the party has hardened and national conditions matter more than incumbency.

Likely districts sit further from the center of the fight, but they still shape strategy in a narrow cycle. When the national environment shifts sharply, these seats influence how parties allocate resources, where they play defense, and how aggressively they expand the map late. In a year where a five-point national advantage does not guarantee a wave, even Likely districts can become relevant if one side achieves a breakout performance or the other falters operationally.

Together, Lean and Likely districts define the perimeter risk of the 2026 House map. They are not where the fight begins, but they are where it can unexpectedly spread, turning a contained contest into a broader, more volatile battle for control.

Read the full article: The Midterm Mirage: Why a D+5 Environment Doesn’t Mean a Democratic Wave

Four States That Shape the Majority

Together, California, New York, Michigan, and Pennsylvania form the structural foundation of the 2026 House battlefield. These states host the densest clusters of competitive districts and the most electorally sensitive voter coalitions.

California and New York: The Coastal Battlegrounds

California and New York account for more than one-third of all competitive House races. Population churn, affordability pressures, and suburban realignment dominate these contests. California’s Central Valley, Inland Empire, and coastal suburbs present simultaneous Democratic vulnerabilities and opportunities. New York’s Long Island, Hudson Valley, and exurban corridors remain among the most volatile districts in the country.

Read the full article: Coastal Comeback or Collapse: California and New York’s 2026 Stakes

Michigan and Pennsylvania: The Industrial Core

Michigan and Pennsylvania anchor the industrial spine of the national map. These states combine union fragmentation, suburban diversification, and economic identity voting. Districts across south-central Michigan and Pennsylvania’s Lehigh and Harrisburg corridors remain razor-thin and highly responsive to cost-of-living sentiment, job security, and candidate credibility.

Read the full article: The Industrial Battleground of Michigan and Pennsylvania in 2026

Why Media Bubbles Shrink the Battlefield

The 2026 House map rewards discipline and punishes overreach. For Republicans, exposure in Toss-Up districts demands tight message control, efficient defense, and restraint in expansion. Maintaining credibility with suburban moderates, older voters, and economically stressed independents is essential, particularly as national conditions weigh more heavily than incumbency in vulnerable seats. Overcommitting resources to long-shot districts risks weakening the core and accelerating losses where margins are already thin.

A growing share of voters in competitive House districts are no longer reachable through conventional persuasion. These voters are not undecided in the traditional sense. They are insulated by tightly closed media ecosystems that filter out opposing information and reinforce partisan identity.

This insulation dramatically reduces the effective electorate in swing districts, helping explain why national polling advantages increasingly fail to translate into proportional seat gains. Even when the national mood shifts, district-level movement is often muted to one or two points. As a result, campaigns are being forced to rethink strategy. Persuasion is no longer the dominant path to victory. Mobilization, turnout discipline, and base activation now offer more reliable returns in a compressed battlefield.

Read the full article: The Unreachable Voter: How Media Bubbles Are Remaking the 2026 Battlefield

The Generic Ballot, Explained: What the National Number Really Measures

The generic congressional ballot is one of the clearest indicators of national political mood, but it is often misread. It captures the direction and intensity of voter sentiment, not precise seat outcomes or district-level results.

A Democratic D+5.3 advantage signals a materially hostile environment for the party in power and helps explain why analysts are now modeling early double-digit GOP exposure. But that number does not move every district equally. National gains are frequently concentrated in safe seats, while competitive districts shift more slowly and unevenly.

For campaigns, the generic ballot serves as a strategic backdrop. It shapes expectations, fundraising, and resource allocation, but it cannot replace district-specific execution. A D+5.3 environment opens the door to losses. Whether they materialize depends on how well campaigns navigate the map.

Read the full article: D +5.3 Generic Ballot Advantage Signals Early Double-Digit GOP Exposure

Why Gerrymandering Can’t Save a Majority

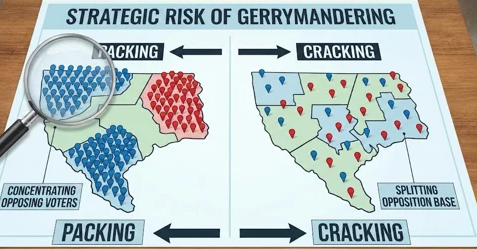

Aggressive redistricting has reshaped the House map, but it has not eliminated risk. In many cases, cracking and packing voters has produced narrower, more brittle majorities rather than durable insulation. Seats that look secure on paper often rely on finely balanced margins that are highly sensitive to national mood.

By spreading partisan voters more efficiently across districts, map-drawers frequently thin margins in surrounding seats, increasing exposure in wave environments. A strategy designed to lock in control can instead amplify downside risk, turning “safe” districts into liabilities when turnout shifts or presidential approval declines.

The 2026 cycle reflects these limits clearly. Despite aggressive map-drawing and a permissive legal environment, neither party has achieved lasting structural dominance. Retaliatory gerrymandering, litigation, public backlash, and demographic change have combined to keep the battlefield tight, contested, and responsive to relatively small shifts in sentiment. Redistricting can shape the battlefield, but it cannot override political gravity. When the national environment turns, map power bends before it breaks.

Read the full article: Why the GOP’s Gerrymandering Gamble Could Backfire

The Primaries That Shape the General Election

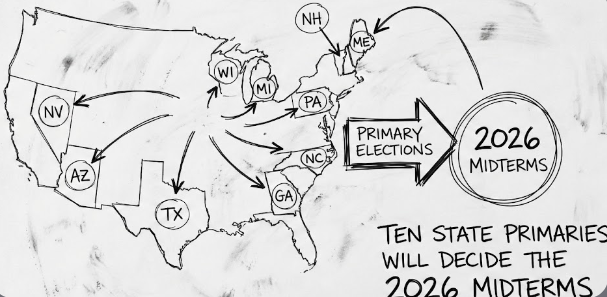

The 2026 midterm map is being set long before November by ideologically distinct primary electorates in a small number of high-impact states. In places like Arizona, Georgia, Michigan, Pennsylvania, Texas, and beyond, crowded primaries and open-seat contests are forcing candidates to adopt clear, often rigid positions early in the cycle.

Surviving these primaries comes with a tradeoff. Candidates emerge finely tuned to the demands of their state’s primary voters, but frequently constrained in their ability to pivot toward independents and moderates in the general election. Issue priorities, character expectations, and perceived threats vary sharply by state, making a single national message ineffective.

In a cycle likely to be decided on the margins, the candidates who matter most may not be the ones with the strongest November messaging, but the ones who can navigate primary demands without foreclosing general-election viability. How these early contests shape the field may ultimately determine control of Congress.

Read the full article: Ten State Primaries Will Decide the 2026 Midterms

A New Era of Knife-Edge Majorities

In a House fight this tight, primaries are no longer a warm-up act. They are the filter that determines which candidates are even capable of winning in November. The 2026 majority will not be lost on Election Day alone. It will be shaped, constrained, and in many cases decided months earlier, in low-turnout contests where ideology hardens, messages narrow, and flexibility disappears. The parties that ignore this reality do so at their own risk.