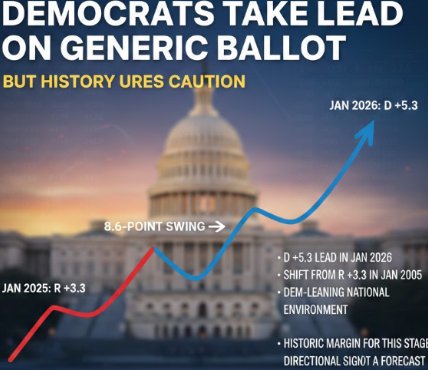

A year post-Trump's inauguration, the generic congressional ballot flipped from a Republican lead to a significant Democratic advantage, foreshadowing a difficult 2026 midterm for the GOP.

What to Know

- Democrats now lead the generic congressional ballot by an average of 5.3 points.

- This represents a nearly 9-point swing from the Republicans' 3.3-point lead one year ago.

- The shift directly coincides with President Trump’s declining approval ratings over the past year.

- The polling average is a weighted indicator, not a simple collection of recent polls.

- The ballot currently functions as a measure of the national mood, not a predictor of specific seat counts.

A year into President Trump’s second term, the national political mood has turned sharply against Republicans. According to Nate Silver’s Silver Bulletin 2026 generic congressional ballot average, Democrats now hold a 5.3-point advantage, a dramatic reversal from the Republicans’ 3.3-point lead at the time of Trump’s inauguration. That nearly 9-point swing reflects a rapid deterioration in the governing party’s standing and aligns closely with Trump’s declining approval ratings over the past year.

The Silver Bulletin’s average is not a simple aggregation of recent polls but a weighted model that prioritizes pollster reliability, sample size, and recency, making it a useful measure of national sentiment rather than a seat-by-seat forecast. While the generic ballot does not predict exact outcomes, movements of this magnitude historically signal a hostile midterm environment for the incumbent party. If these trends persist, Republicans could enter the 2026 cycle facing the kind of structural headwinds that have preceded significant midterm losses in past elections.

The Shifting Battlefield

The reversal in momentum between the two parties is no longer subtle. What looked like a durable Republican advantage in the immediate aftermath of the 2024 elections has given way to a far more contested environment. President Trump’s net approval has slipped, while Democrats posted strong performances in the 2025 off-year elections, a classic early warning sign for the party in power.

That shift has immediate strategic implications. For Democrats, it provides a concrete proof point to energize their base, attract higher-quality recruits, and unlock fundraising by arguing that the political environment is turning in their favor. For Republicans, it underscores a familiar midterm dilemma: congressional candidates tied to a struggling president inherit national headwinds they cannot fully control.

As one recent analysis in New York Magazine observed:

“Some Republican candidates in 2026 will choose to cleave to Trump even more fiercely, and others may try to achieve some distance, but they’re probably joined at the hip for better or worse.”

That tension defines the 2026 battlefield. Republicans must decide whether doubling down on the president energizes enough of the base to offset losses among swing voters, while Democrats are betting that national dissatisfaction can be localized into dozens of winnable House races. In a cycle likely to be decided at the margins, those strategic choices may matter as much as the underlying map itself.

How the Average Works

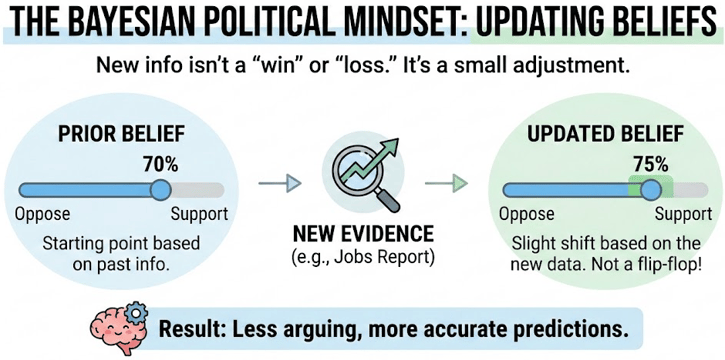

It is critical to understand that the generic ballot average is not a single poll, nor is it a simple arithmetic mean. Models such as Silver Bulletin are designed to extract signal from noise by systematically weighting all available polling data. Polls are adjusted based on pollster historical accuracy, sample size, recency, and whether the survey measures likely voters rather than registered voters. The goal is not perfection, but calibration.

As Nate Silver explains in his discussion on the mechanics of polling and prediction, modern polling suffers from uneven response rates and demographic skews. Older voters, women, and politically engaged individuals are far more likely to respond to surveys than younger or disengaged voters.

Nate Silver Photo credit: NASA / David C. Bowman

Because of that imbalance, no single poll can be taken at face value. The model compensates by incorporating many imperfect inputs rather than overreacting to any one of them.

“People sometimes complain that polls are wrong. I think the reverse is true. To me, it’s amazing they work at all with all the issues we have with polls… We’re saying, ‘What do we know, and what don’t we know?’”

— Nate Silver, speaking at NASA Langley Research Center

This approach reflects a Bayesian mindset: probabilities are updated incrementally as new information arrives, rather than overturned by the latest data point. For campaigns, the implication is straightforward.

The weighted average is far more reliable than any individual survey, especially one with a small sample or weak track record. Overreacting to outlier polls is a strategic mistake. The value of the average lies in its durability. It offers a clearer read on the underlying political environment precisely because it resists being whipsawed by daily polling noise.

Reading the Signal, Not the Noise

The generic ballot is best understood as an early-warning system, not a standalone verdict. Day-to-day movement is inevitable, and campaigns that overreact to minor fluctuations risk mistaking randomness for momentum. Individual polls will disagree, and weighting models will periodically elevate certain surveys based on size, methodology, or timing. None of that, by itself, constitutes a meaningful shift.

What matters is confirmation across indicators. As Amy Walter explained in a January 27, 2026 analysis for Cook Political Report, the generic ballot gains significance when it aligns with real-world voting behavior:

“The generic ballot is the first alert, but it’s not the whole story. When voters actually show up, they are confirming the trend we see in the national polling. That’s a signal, not noise.”

That distinction is critical for strategists. A single poll can mislead, but a sustained trend reinforced by special election results, turnout patterns, and fundraising performance is harder to dismiss. The task for candidates and campaigns is not to chase daily swings, but to recognize when multiple data points are pointing in the same direction. Durable movement over weeks or months is what signals a real change in the political environment, and strategy should be built around that reality, not the volatility of any given news cycle.

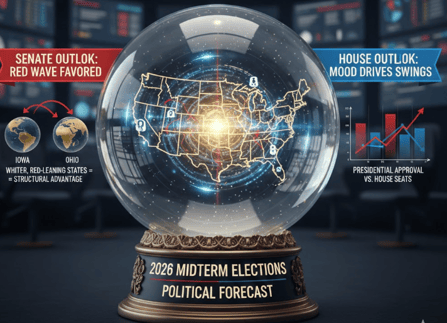

Midterm Elections and Presidential Approval

The historical pattern of midterm elections is well established: the party holding the White House almost always faces losses, especially when presidential approval softens. The 2026 cycle is increasingly fitting that mold. President Trump’s standing has weakened since the start of his second term, and national indicators now resemble the early stages of previous wave elections.

Analysts at the Center for Politics have explicitly warned that the national environment is turning hostile for Republicans, even if the consequences differ by chamber. In its January 2026 Crystal Ball analysis, the organization framed the moment in familiar historical terms:

“The 2026 midterm may once again be a ‘Blue Wave,’ as we saw in 2018, Donald Trump’s first midterm as president.”

At the same time, the Crystal Ball makes clear that presidential unpopularity does not translate evenly across the electoral map. Despite what it describes as “likely to be a difficult national political environment this fall,” Republicans remain favored to hold the Senate because of the structure of the races in whiter, red-leaning states such as Iowa and Ohio. That structural insulation does not exist to the same degree in the House, where national mood and presidential approval exert far greater influence.

The result is a familiar but asymmetric midterm dynamic. Trump’s declining approval creates clear headwinds for Republican House candidates and fuels Democratic optimism, while the Senate remains more resistant to a full wave. Presidential approval still matters enormously, but in 2026 its effects are being filtered through a map that amplifies Democratic opportunity in the House even as it limits their ceiling in the Senate.

A Look at the Polls

The 2026 generic congressional ballot has undergone a dramatic reversal over the past year, underscoring how quickly national political conditions can change. When President Trump began his second term, Republicans were buoyed by their 2024 victories and a perceived conservative momentum. Polling reflected that confidence. On Inauguration Day, the generic ballot stood at R+3.3, according to the newly launched 2026 polling average from Silver Bulletin.

One year later, the landscape looks markedly different. Trump’s approval has slid from positive territory into historically weak territory for a modern president, and Democrats have capitalized on that shift with strong performances in the 2025 off-year elections. As Silver Bulletin’s tracker now shows, the generic ballot has moved decisively toward Democrats:

“Today, our average has the generic ballot at D+5.3. That’s an 8.7-point shift toward Democrats over the past year.”

— Silver Bulletin, updated January 29, 2026

That swing places Democrats behind where they stood at this point in 2018, when the ballot hovered around D+9, but ahead of the opposition party’s position in several other recent midterm cycles. The magnitude and persistence of the shift matter more than any single data point. The value of the average lies in its methodology: polls are weighted by pollster reliability, sample size, recency, and voter type, with likely-voter surveys prioritized where available.

For campaigns, the takeaway is straightforward. An 8.7-point national swing is not noise, and it is not easily dismissed as polling volatility. In a House landscape filled with narrowly drawn districts, a D+5 environment materially alters which races are competitive, where money flows, and how parties allocate resources. The generic ballot does not predict exact seat totals, but it provides a clear and continuously updated signal of the direction of the national mood, one that strategists ignore at their peril.

The Path to a Majority

While the generic ballot is a powerful indicator, it is not a crystal ball. A lot can change between now and Election Day, and the final outcome of the 2026 midterms will depend on a variety of factors, including the state of the economy, the quality of the candidates, and the effectiveness of their campaigns.

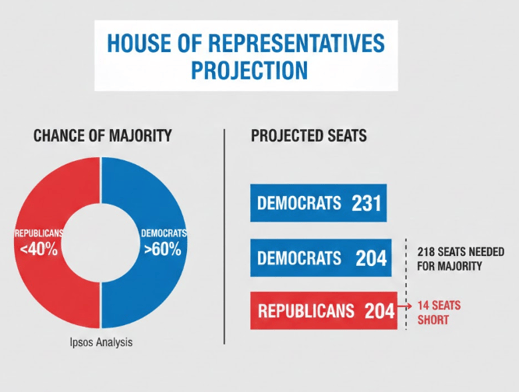

However, the current data suggests that Democrats are in a strong position to retake the House of Representatives. An analysis by Ipsos, which considers four different projection models, gives Republicans less than a 40% chance of holding onto their majority. The average of these four projections has Republicans ending up with 204 seats, 14 short of the 218 needed for a majority.

The battle for the Senate is more complicated, as it is fought on a state-by-state basis. However, a strong national environment for Democrats could also put them in a position to pick up seats in the upper chamber. Nate Silver of the Silver Bulletin has suggested that a 7-point lead in the generic ballot could be enough for Democrats to flip the Senate.

A President's Impact on His Party

What makes this moment especially risky for Republicans is that an issue long viewed as one of President Trump’s strongest advantages is beginning to invert. Immigration enforcement helped unify the GOP coalition and provided a sharp contrast with Democrats. Now, it is showing signs of becoming a political liability, particularly in competitive districts.

As John Feehery told Reuters, the problem is not erosion within the Republican base, but exposure beyond it:

“This was one of the president’s number one advantages, and it has become a political liability for him. The base is still pretty comfortable with what Trump is doing. But it’s not just about the base, it’s about swing voters.”

That distinction is critical in a midterm environment defined by narrow margins. Republicans may continue to dominate on immigration with core voters, but midterms are decided by independents and suburban swing voters who respond less to ideological signaling and more to perceptions of competence, control, and restraint. When enforcement actions appear chaotic or overly aggressive, strength can be reframed as instability.

John Feehery image via the Ripon Forum

In a cycle where dozens of races will be decided at the margins, even small shifts among swing voters can outweigh base enthusiasm. If immigration moves from a mobilizing advantage to a credibility problem outside the GOP base, it weakens one of Republicans’ most reliable issue pillars heading into 2026.

Wrap Up

The nearly 9-point swing in the generic ballot sets the fundamental terms of engagement for the 2026 midterms. It tells the story of a political environment that has moved steadily away from the president’s party over the last year. This trend will directly impact candidate recruitment, fundraising, and messaging, forcing Republicans to confront a challenging national mood while giving Democrats a crucial tailwind.

Looking ahead, the generic ballot will eventually be integrated into forecast models that predict seat counts. For now, it serves as the most important barometer of the nation’s political temperature. The central question for 2026 is whether Democrats can maintain this advantage as the election draws closer. The answer will determine control of Congress and shape the final two years of President Trump's term.