Democrats’ breakthrough in Georgia’s utility regulator elections signals a new electoral battlefield where electricity prices, data centers, and ratepayer anger are reshaping 2026.

What to Know

- Georgia Democrats won two statewide seats on the Public Service Commission, the first time the party has done so in nearly twenty years.

- Rising electricity prices and the costs of new data center infrastructure became central issues for voters across Georgia and other states.

- Virginia and New Jersey governor races also turned on “affordability,” suggesting a national trend toward energy price politics.

- PJM states, including Pennsylvania and Maryland, are already pressuring grid operators to restrain power costs linked to AI data center growth.

- Energy affordability and utility oversight are now major 2026 campaign issues, with both parties shaping messages around cost of living and energy supply.

Georgia’s Public Service Commission elections drew more national attention than usual this year, as voters responded to escalating electricity prices and mounting frustration over how utilities manage the state’s rapid growth. Two Democratic candidates, Peter Hubbard and Alicia Johnson, defeated incumbent Republicans and delivered the party’s first statewide wins in nearly two decades.

Peter Hubbard (left), Alicia Johnson (right)

Their victory did not occur in isolation. It followed sweeping Democratic wins in Virginia and New Jersey, where campaigns centered on energy costs, data center expansion, and the burden placed on household utility bills. Together, these races point to a major political shift: energy policy and electricity affordability are becoming decisive issues heading into the 2026 midterms.

A New Era of Utility Politics in Georgia

The Georgia Public Service Commission regulates electricity, natural gas, and major utility investments. Historically, these elections attracted low turnout and limited partisan engagement. That changed as power bills increased and data centers expanded across the state. Voters began associating utility regulation with economic stability. Hubbard and Johnson campaigned on promises to restrain rate increases, scrutinize utility spending, and demand more transparency.

Their wins have far reaching implications. With two new Democratic commissioners, decisions about rate cases, fuel cost adjustments, grid modernization, and data center interconnections will be viewed through a political lens. Ratepayers expect immediate relief, even though the commission’s authority operates within state statutes and federal market constraints. Energy analysts warn that voters may be expecting faster change than regulators can practically deliver, but they also agree that this is the most significant political shift in Georgia energy oversight in decades.

Affordability Becomes the National Fault Line

The Georgia results reflect a broader pattern visible in Virginia and New Jersey. Candidates like Abigail Spanberger in Virginia and Mikie Sherrill in New Jersey won their gubernatorial races after centering their campaigns on the cost of electricity.

Abigail Spanberger (left), Mikie Sherrill (right)

Spanberger tied rising bills to data center growth and promised to produce more in state power to lower costs. Sherrill pledged to freeze utility rates on day one. Both framed energy prices as kitchen table economics rather than environmental debates.

Data from the Bureau of Labor Statistics shaped their messaging. Over the 12 months ending in September 2025, electricity prices rose a little over 5% nationwide, while natural gas prices jumped nearly 12%. Both increases ran ahead of overall inflation at about 3% and hit households already stretched by higher food and housing costs.

|

Category |

12-month change (Sept 2025) |

Why it matters |

|

All items (overall inflation) |

3.00% |

Baseline comparison |

|

Electricity |

5.10% |

Outpaced inflation, strains households |

|

Natural gas |

11.70% |

One of the largest increases |

|

Shelter |

3.60% |

Housing costs rising faster than inflation |

|

Food |

3.10% |

Everyday essentials more expensive |

|

Meats/poultry/fish/eggs |

5.20% |

High grocery-cart pressure |

|

Nonalcoholic beverages |

5.30% |

Another high food-related spike |

|

Used cars & trucks |

5.10% |

Transportation costs remain elevated |

|

Household furnishings & operations |

4.10% |

Increased cost of maintaining a home |

|

Medical care services |

3.90% |

Healthcare rising faster than inflation |

Data via Bureau of Labor Statistics

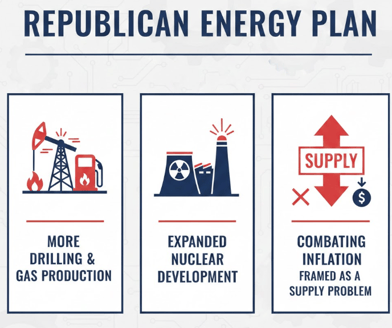

Democrats blamed Trump administration cuts to clean energy projects and a renewed reliance on fossil fuels. Republicans framed the issue as a supply problem and called for more drilling, more gas production, and expanded nuclear development.

Georgia voters heard these national arguments, but their worries were close to home. Rapid population growth, large industrial projects, and rising demand on the grid left many families paying higher power bills without a clear explanation. Hubbard and Johnson tapped into that ratepayer frustration, building a coalition that cut across party lines.

The Data Center Pressure Point

Few issues shaped this election cycle more than the surge in data centers. Georgia, like Virginia, has become a hub for AI infrastructure requiring massive electricity loads. Every new facility demands substation upgrades, new transmission lines, and increased generation capacity. Those costs often fall on ratepayers, not on the companies building the data centers.

This clash is clearest in Virginia, where data centers are a top political issue. In Northern Virginia, some legislative contests turned almost entirely on whether candidates supported or opposed new data center projects. One House of Delegates candidate, John McAuliff, won his race after campaigning on stricter oversight. Spanberger used similar themes statewide.

Georgia is now entering the same arena. Utilities welcome the tax base data centers create, but they also warn that customers may face higher bills unless companies cover more of the infrastructure costs. The Public Service Commission will soon be asked to decide how much data centers should pay and how much ratepayers should shoulder. These decisions will have direct consequences for millions of Georgians and for industries trying to expand in the state.

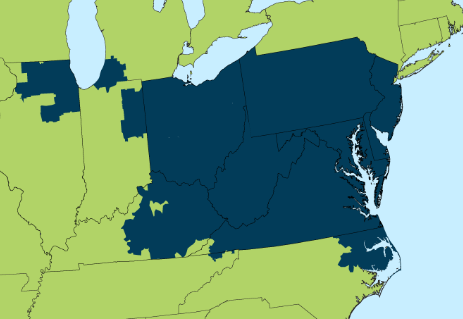

The PJM Signal and Its Broader Impact

While Georgia is not part of the PJM Interconnection, the political dynamics within PJM states are influencing national energy debates. Wholesale electricity prices in PJM rose 41% in the first half of 2025, driven largely by data center load additions. Governors in Pennsylvania, Maryland, Illinois, and Kentucky have pressed PJM to stabilize costs and prevent unchecked data center development from overwhelming the grid.

Screenshot of image of PJM Territory Served

Georgia lawmakers and regulators are watching closely. PJM offers a preview of what happens when energy demand rises faster than generation can be added. The political consequences are now visible in the ballot box. Georgia’s flip is an early indicator that regions outside PJM facing similar pressures will see energy oversight become a major campaign issue.

A Window Into 2026

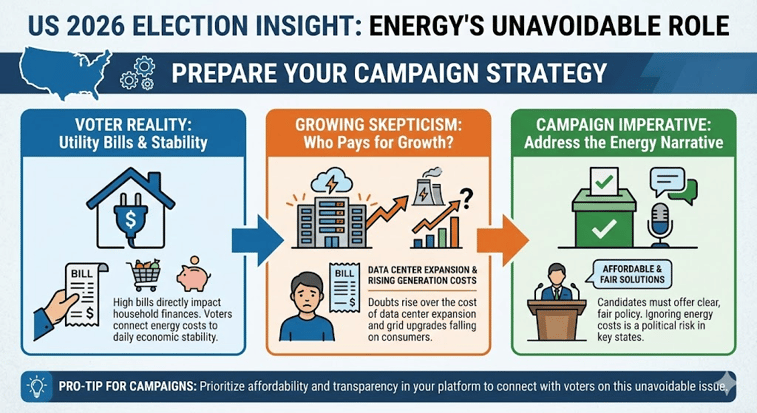

Democrats now hold two of the most influential utility regulatory positions in the Southeast. Their success highlights a national shift toward treating energy affordability as a core economic issue rather than a niche regulatory matter. For campaigns preparing for 2026, energy messaging will be unavoidable. Voters are connecting utility bills to household stability, and they are increasingly skeptical of both data center expansion and rising generation costs.

Republicans are also recalibrating. Candidates like Vivek Ramaswamy in Ohio have already incorporated electricity prices into their affordability platforms. Trump has tried to reclaim populist credibility by framing energy costs as a Republican issue. The question for 2026 is which party can deliver a clearer, more practical explanation for why prices are rising and what they plan to do about it.

Wrap Up

Georgia’s Public Service Commission flip marks a turning point in the politics of electricity. Energy affordability has moved from the background of state policy into the center of electoral strategy. The victories of Hubbard and Johnson demonstrate that voters are willing to cross party lines when they believe regulators can lower bills and restrain powerful utilities. Their success also signals a new political frontier: campaigns that can connect electricity prices to everyday economic pressures will have an advantage in 2026.

Looking ahead, both parties must adapt. Democrats will try to build a coalition around affordability, clean energy growth, and ratepayer fairness. Republicans will push a message focused on expanding supply, job creation, and limiting regulation. With data centers growing, infrastructure strained, and prices rising, voters are paying close attention. The battles over utility oversight in Georgia preview the national energy fight that will define the next cycle.